Property Development Finance

Development finance is amongst the more complex property finance products, but there is typically more room for negotiation with the lender on the terms of the loan documentation. It is therefore critical that you have the right lawyer in your corner who can really add value by improving the terms of the loan for you.

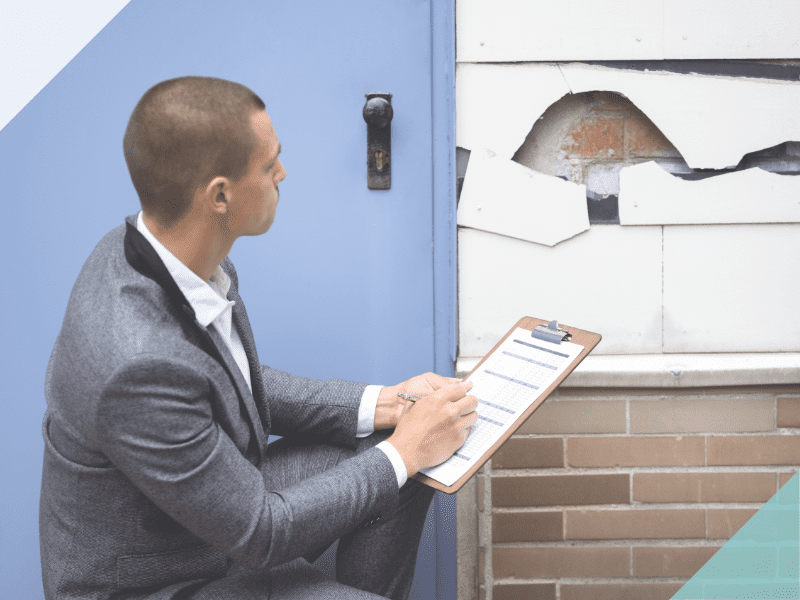

Property development finance can provide short-term funding for either more extensive new construction projects or large renovations, helping developers to free up their personal capital for other projects or unforeseen expenses.

Building Loan

Loans cover both land purchase and building costs. Loan amounts are based on a percentage of the gross development value at the end of the work. Usually, development loans are drawn in stages (referred to as ‘tranches’). Part of the loan will be drawn to acquire the land, and subsequent funds drawn for the development.

Reporting to the lender

The reporting criteria to the lender are usually very strict in Development Finance to ensure that the property is being developed in accordance with a plan approved by the lender. There will virtually always be ‘step-in’ rights allowing the lender to complete any development work to ensure that their security is protected.

Get in touch with us today to receive a quote and kick start the process.

Additional Fees

In addition to the fixed fee above the following fees may also be payable:

- Payable in all cases – Bank Transfer Fee (per transfer) – £40 plus VAT

- Payable in all cases – Electronic Identification Fee (per person) – £10 plus VAT

- Search Fees will vary from the type of finance but between £550 and £1500 plus VAT

Disbursements

Land Registry Fees are due and will be payable based upon the purchase price.

If the buyer is a company taking lending, a Companies House fee will be payable of £23.

In all cases, bankruptcy and final search fees will be due of £25.

If the premises are leasehold, then notice of the transfer of the premises will need to be served on the landlord, whose costs typically range from between £50 and £200. We will confirm the figure once it is known to us.

How long will it take?

Timescales vary and on average it will take 6-8 weeks, but it depends upon several factors outside of our control. We will endeavour to complete the finance as quickly as possible within your timescales.

What is included?

Ensuring the lender has a good and marketable title

Reporting to you on the security documentation

Discharging any existing lending

Securing any new lending

Registration of the security at HM Land Registry

Registration of the security at Companies House

Completion of the refinance

What is excluded?

Legal advice outside the scope of the service described above

Tax advice

If the property is leasehold, it does not include any additional work in connection with the review of the head lease.

Any property transfers needed for the property finance

Any company work outside of the finance that is required

What you can expect when instructing Attwells Solicitors

Development Finance Articles

Attwells Solicitors are property law experts, we understand that property developers and investors are keen to know the latest property news but don’t necessarily have the time to unpick the jargon. Thankfully we are a jargon-free law firm. If you would like to read our latest article please subscribe.