Property Development Solicitors

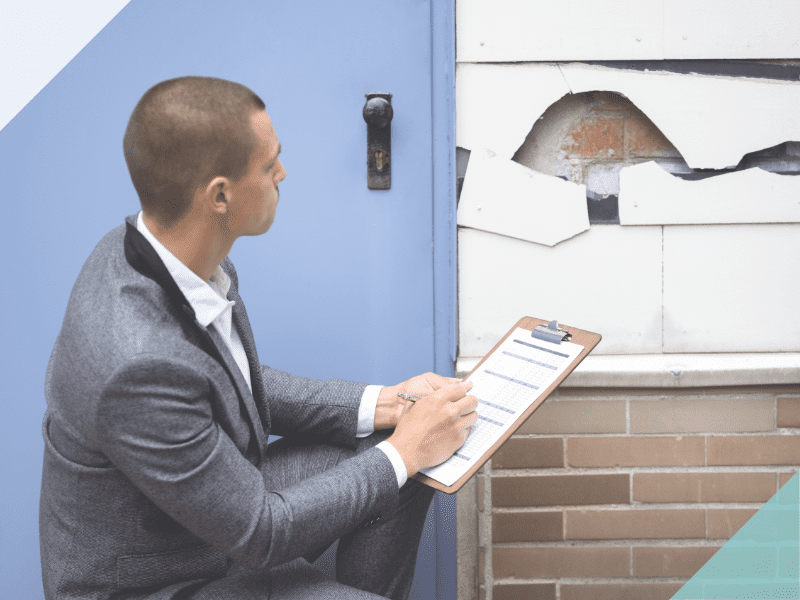

Helping developers to secure land or property for their development is a core part of Attwells Solicitors’ property law proposition. We work with planners, estate agents, and brokers to offer developers across the south of England a fast and effective legal solution.

Unlike most other legal firms, Attwells explain the law in jargon-free terms. We also pride ourselves on picking up the phone, as we understand that when you are on-site it’s easier for you to talk.

How can property developers increase their profit?

Buying well is very important. Anything that you can do to reduce the cost of purchase will go straight to your bottom line in terms of profitability. The skill is not to overpay, and to understand where you can add value.

This will involve you in discussions and negotiations with landowners. Ideally, the property developer will want to secure control of the property or land at an agreed price and then apply for planning or look to intensify the planning.

In recent years we have seen a lot of promotion agreements where the landowner and a promoter (who may be a developer) of the site agree to split the profits of the land on the basis that the promoter has control of the site to apply for planning and then agrees to offer the land for sale. If the promoter is a developer then often they will have the right to purchase the land too.

Land agents will have land for sale but it is likely that the planning value uplift is already built into the sale price. It will be for your planners to identify whether they could intensify the development with tweaks to planning and/or whether you can still generate a good return notwithstanding the land price.

In working out how much to pay you will need to have done a development appraisal and worked out the gross development value of the site. The gross development value (GDV) is the projected value of the site once it has been completed. In order to calculate GDV, the developer needs to analyse recent property transactions in the area to identify a realistic sale price for the units.

Property Law Articles

Attwells Solicitors are property law experts – we understand that property developers are keen to know the latest property news but don’t necessarily have the time to unpick the jargon. Thankfully we simplify the law. If you would like to read our latest article, please subscribe.